Texas proposes strategic bitcoin reserve: A new era for state financial management

By ljdevon // 2025-02-14

Tweet

Share

Copy

In a groundbreaking move that could redefine how states manage their finances, Texas has introduced Senate Bill 21 (SB21), a legislative proposal to establish the Texas Strategic Bitcoin Reserve. Filed on February 12, 2025, by Senator Charles Schwertner, the bill aims to position Texas as a leader in state-level cryptocurrency adoption by creating a dedicated Bitcoin reserve managed by the state comptroller. This initiative marks a significant shift in public financial strategy, as it explores the potential of Bitcoin as a store of value and a hedge against inflation. If successful, the proposal could not only boost Bitcoin's price but also create long-term wealth for the state, setting a precedent for other states to follow.

The proposal: a new frontier for state finances

The Texas Strategic Bitcoin Reserve would be overseen by the state comptroller, who would be responsible for managing investments in Bitcoin. This move is part of a broader trend among states and institutions exploring digital assets as a means of diversifying financial portfolios. By allocating a portion of state funds to Bitcoin, Texas aims to capitalize on the cryptocurrency's unique properties, particularly its limited supply of 21 million coins. This scarcity has historically driven Bitcoin's value upward, making it an attractive investment for those seeking long-term growth. The bill outlines a strategic approach to Bitcoin investment, emphasizing the need for careful management and risk mitigation. The comptroller would be tasked with balancing the potential rewards of Bitcoin's price appreciation against its inherent volatility. This dual focus on innovation and prudence reflects Texas's ambition to lead in the rapidly evolving world of cryptocurrency while safeguarding public funds.Economic implications: A double-edged sword

The establishment of a state-level Bitcoin reserve could have far-reaching economic implications. On one hand, institutional investments in Bitcoin have historically driven its price upward. If Texas's reserve becomes a reality, it could signal to other states and institutions that Bitcoin is a legitimate and viable asset class. This could lead to increased demand for Bitcoin, further boosting its price due to its limited supply. On the other hand, Bitcoin's volatility presents significant risks. The cryptocurrency market is known for its dramatic price swings, which could pose challenges for state financial managers. The comptroller would need to implement robust risk management strategies to protect public funds from sudden market downturns. However, if managed effectively, the long-term rewards could outweigh the risks. Bitcoin's potential to act as a hedge against inflation and a source of long-term wealth makes it an appealing option for states looking to secure their financial futures.Potential nationwide impact

Texas's proposal could set a precedent for other states to follow. As the first state to establish a dedicated Bitcoin reserve, Texas would position itself as a leader in cryptocurrency integration. This could attract businesses and investors seeking to operate in a forward-thinking financial environment, further boosting the state's economy. Additionally, the success of the Texas Strategic Bitcoin Reserve could encourage other states to explore similar initiatives, leading to a nationwide shift in public finance. The broader adoption of Bitcoin by states could also enhance its legitimacy and stability as an asset class. As more states invest in Bitcoin, its market presence would likely become more robust, reducing some of the volatility associated with the cryptocurrency. This could create a positive feedback loop, where increased adoption drives price stability, which in turn encourages further adoption.Balancing risks and rewards

While the potential rewards of the Texas Strategic Bitcoin Reserve are significant, the proposal is not without its challenges. Regulatory clarity around cryptocurrencies continues to evolve, and the comptroller would need to navigate a complex and rapidly changing legal landscape. Additionally, the volatile nature of Bitcoin means that the reserve would need to be managed with a long-term perspective, focusing on gradual growth rather than short-term gains. Despite these challenges, the potential benefits make the initiative worth considering. Bitcoin's limited supply and growing adoption suggest that it could offer substantial returns over the long term. For states like Texas, which are already known for their innovative approaches to finance, the Bitcoin reserve could provide a competitive edge in attracting businesses and investors. Sources include: X.com NaturalNews.com NaturalNews.comTweet

Share

Copy

Tagged Under:

Texas regulations big government finance investments bitcoin risk money supply bubble progress cryptocurrency currency reset inflation hedge comptroller currency crash economic riot finance riot bitcoin reserve competitive edge financial futures

You Might Also Like

I Want My Bailout Money – new song and music video released by Mike Adams

By Mike Adams // Share

Trump bans federal funding for chemical and surgical mutilation of children

By Laura Harris // Share

Conspiracy theorists were right about everything – Now what?

By News Editors // Share

Trump’s DOGE reforms hit D.C. hard, but nation’s job market remains strong

By Cassie B. // Share

Trump administration secures historic U.S.-Mexico military border patrol agreement

By Cassie B. // Share

Recent News

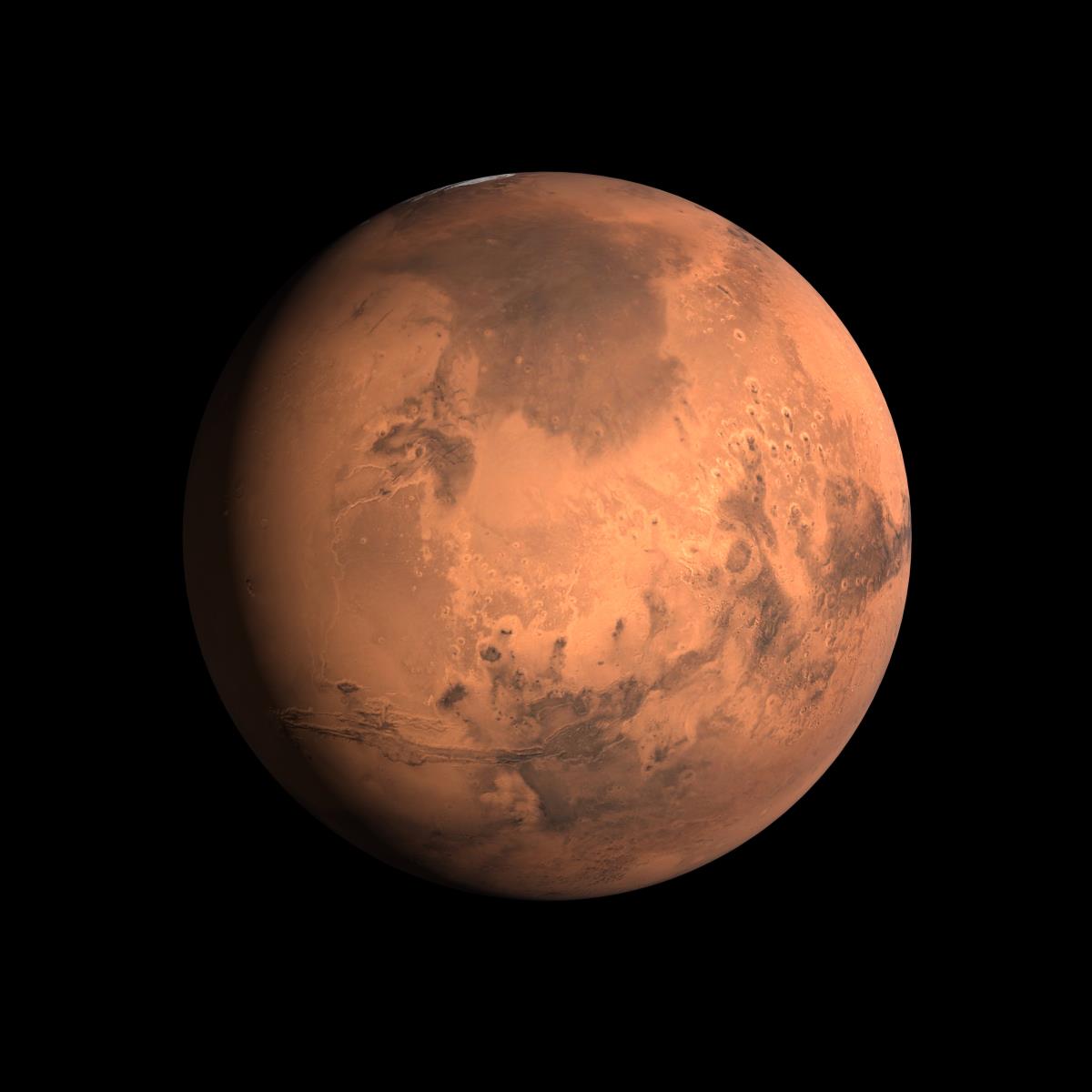

Earth-like soil patterns on Mars reveal clues to the planet’s climate history

By willowt // Share

Virologist who endorsed HCQ for COVID-19 appointed to top pandemic post at HHS

By ramontomeydw // Share