DOGE slashes 500,000 federal credit cards in sweeping anti-fraud crackdown

By isabelle // 2025-05-09

Tweet

Share

Copy

- DOGE, led by Elon Musk, deactivated over 500,000 federal credit cards in a major anti-fraud effort targeting wasteful spending across 32 agencies.

- The crackdown addresses long-standing abuse, with $39.7 billion in annual card spending under scrutiny and AI tools detecting misuse.

- Federal credit cards far outnumber government employees, revealing systemic mismanagement and lack of oversight in the SmartPay system.

- The audit is part of Trump’s broader push to cut waste, with $165 billion in savings claimed so far from agency reforms.

- More deactivations are expected as DOGE works toward a leaner, more transparent federal financial system.

A systemic problem of waste and abuse

Federal credit cards, managed under the General Services Administration’s SmartPay system, have long been a source of controversy. Reports indicate that the government currently holds approximately 4.6 million active cards, a staggering number given the size of the federal workforce. Musk, appointed by Trump to spearhead efficiency reforms, has described the system as a "decades-old ecosystem of waste, fraud, and mismanagement." The sheer volume of unused or misused cards, many of which remained active despite serving no operational purpose, highlights the lack of oversight that has plagued federal spending for years. The deactivation of 500,000 cards is just the first phase of DOGE’s audit efforts. According to agency statements, hundreds of thousands more accounts are under review, with AI-driven monitoring tools and whistleblower channels being implemented to detect irregularities. The move has been praised by fiscal conservatives who argue that lax enforcement allowed unchecked spending to flourish, often at taxpayers’ expense.The scale of the problem

The numbers speak for themselves. In the most recent fiscal year, federal credit cards were used for over 90 million transactions, totaling $39.7 billion, which is a sharp increase from previous years. Musk has pointed out that the number of active cards far exceeds the total number of government employees, raising serious questions about how these accounts were being managed. "Twice as many credit cards are issued and active than the total number of government employees," Musk noted in a recent statement. The audit has already uncovered troubling patterns, including dormant cards that remained open despite years of inactivity. Agencies affected by the deactivations span the federal government, including the Departments of Defense, State, Health and Human Services, and the Environmental Protection Agency. While some officials have downplayed the impact, others acknowledge that the crackdown is necessary to restore fiscal discipline. The credit card crackdown is just one facet of Trump’s larger effort to streamline the federal government. Since taking office, his administration has dismantled entire agencies, including the U.S. Agency for International Development and the Consumer Financial Protection Bureau. DOGE, established by executive order in January, has been at the forefront of these efforts, claiming $165 billion in savings. Musk, whose tenure as a special government employee is set to conclude soon, has framed the initiative as a necessary reset. "A tremendous amount has been accomplished in the first 100 days," he said at a recent Cabinet meeting.What comes next?

With the audit ongoing, DOGE has made it clear that the work is far from over, signaling that additional deactivations and policy changes are on the horizon. The ultimate goal, according to officials, is to create a leaner, more accountable federal financial system where every dollar spent is tracked and justified. For taxpayers weary of government waste, the move is a welcome step toward transparency. Yet, as the administration presses forward, the debate over how to balance fiscal responsibility with operational efficiency will undoubtedly continue. Sources for this article include: YourNews.com TheEpochTimes.com Newsweek.comTweet

Share

Copy

Tagged Under:

Elon Musk collapse government waste big government government spending deep state government debt DOGE

You Might Also Like

White House: Changing a minor’s gender is “child abuse” and “medical malpractice”

By News Editors // Share

Texas launches its own state agency modeled after Elon Musk’s DOGE

By Laura Harris // Share

Musk to step back from DOGE to focus on Tesla amid political backlash

By Cassie B. // Share

A financial coup: How the deep state is using manufactured crises to seize power

By News Editors // Share

Recent News

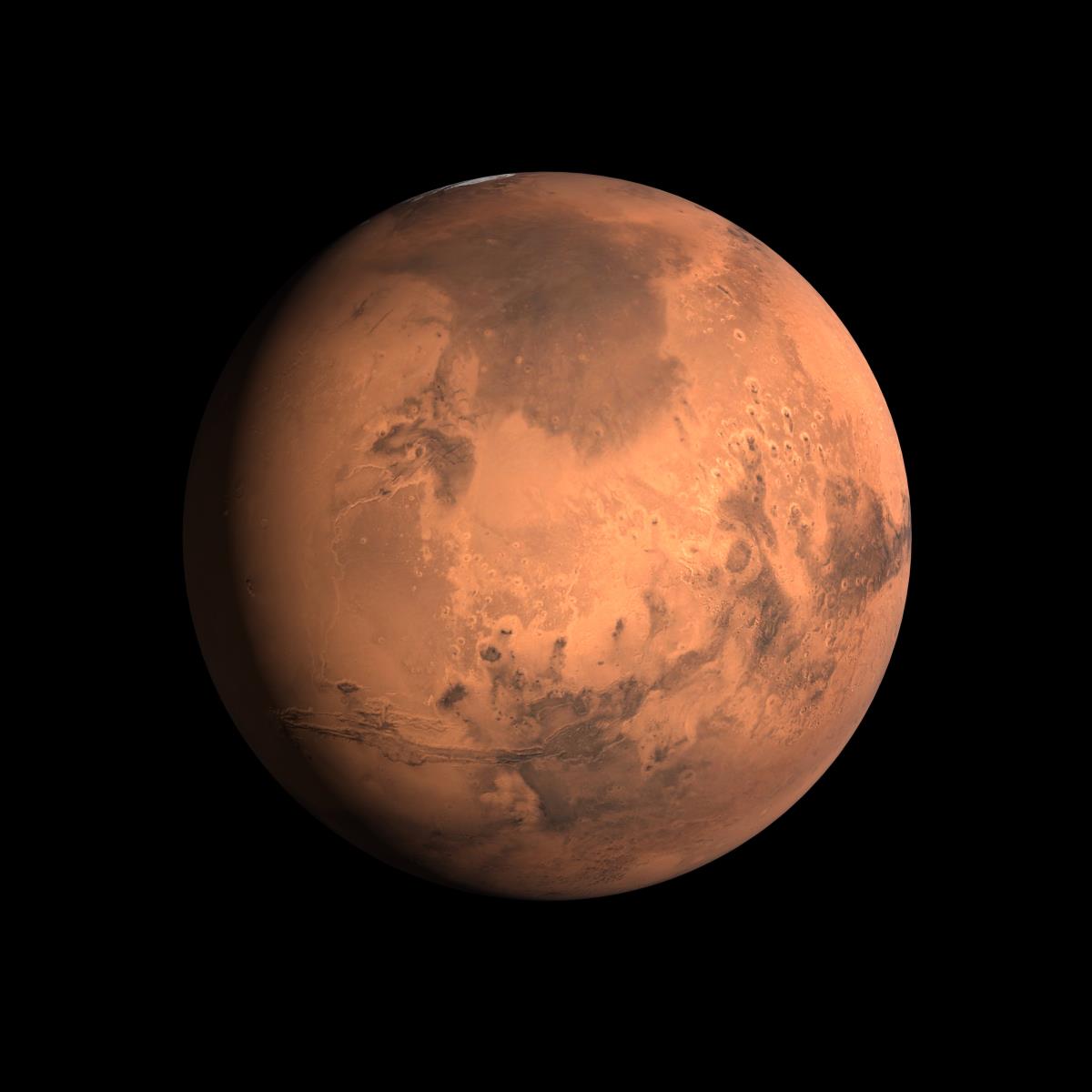

Earth-like soil patterns on Mars reveal clues to the planet’s climate history

By willowt // Share

Virologist who endorsed HCQ for COVID-19 appointed to top pandemic post at HHS

By ramontomeydw // Share